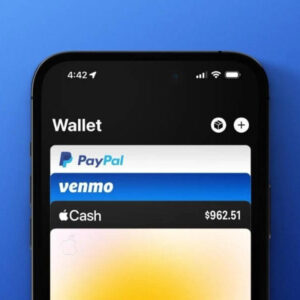

Can I Transfer money from Venmo to PayPal? What Is PayPal? Do you use Venmo or PayPal for peer-to-peer payment transfers? If you use both platforms, there might be a time when you need to transfer money between them. Maybe your friend only uses PayPal, but you have cash in your Venmo account to pay for your dinner. Or maybe you’re purchasing from an e-commerce website that accepts PayPal, but not Venmo, as a form of payment.

Although PayPal owns Venmo, you might be surprised to learn that you cannot transfer funds directly between the two services. Fortunately, there is an easy way to transfer money from Venmo to PayPal as long as both accounts share the same bank account as a funding source.

Can I Transfer money from Venmo to PayPal?

The short answer is no; you cannot transfer money from Venmo to PayPal. Even though the Venmo business is owned by PayPal, there is no direct integration or connection between Venmo and PayPal accounts.

Since there is no interconnection between your PayPal and Venmo accounts, it is not possible to transfer money between them directly.

Does this mean you are stuck? What if you got a big transfer sent to your Venmo account by a family member but use PayPal as your primary account to make online purchases.

Although you cannot send money from Venmo to PayPal directly, it is possible to do so by using a linked bank account. Read on to see how this works.

What Is Venmo and PayPal?

Venmo and PayPal are two of the most popular payment apps on the market. Both apps allow users to send and receive money from friends and family with ease. However, there are some differences between the two apps. For example, Venmo offers a social media-like feed where users can see public transactions made by their friends, while PayPal does not have this feature. Additionally, PayPal allows users to make online purchases with merchants who accept PayPal, while Venmo does not currently offer this option.

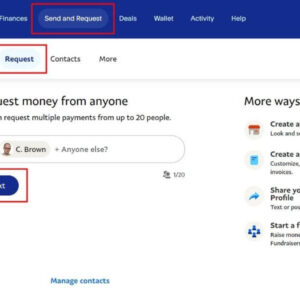

So, how do you transfer money from Venmo to PayPal? In this article, we will walk you through the step-by-step process of how to do just that.

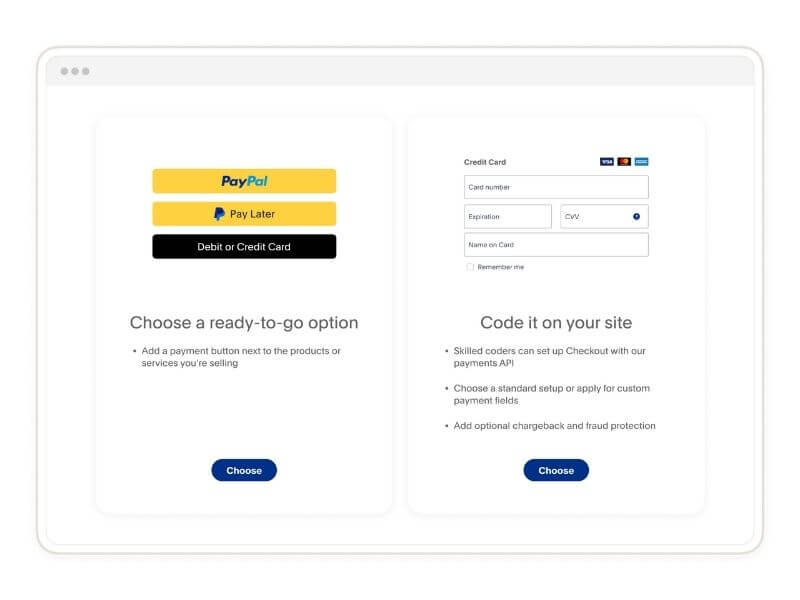

What Is PayPal?

PayPal, established in 1998, is one of the earliest firms offering electronic payments. PayPal began as a way for consumers to transmit money by email or to pay for transactions made on eBay. With 429 million consumer and merchant accounts, PayPal today does business in more than 200 different countries and supports 25 currencies.

PayPal allows users to send and receive money, make online purchases, and even donate to charities. To use PayPal, you will need to create a free account with them.

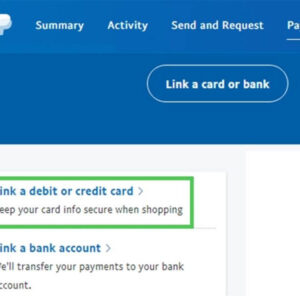

Once you have created an account, you can add money to your balance using your bank account or credit card. Alternatively, you can receive payments from other PayPal users.

There are no or very low fees to send or receive money with PayPal. However, there are some fees associated with certain transactions, such as when you make a purchase using your credit card or when you withdraw money from your PayPal balance to your bank account.

PayPal is a convenient and safe way to transfer money online It is important to remember that you should only ever send money to people who you know and trust. If you are unsure about a transaction, it is always best to contact the person or company directly before sending any money.

What are the Differences between Venmo Standard vs. Instant Transfers?

Venmo has 2 types of transfers available when sending money; these are:

- Standard Transfers

- Instant Transfers

The main differences between both types are in terms of transfer speed and fees.

Standard transfers are free, and usually finish between 1-3 business days. Instant transfers, on the other hand, finish within minutes, but come with a fee. Each transfer is subject to a 1.75% transfer fee, with a minimum fee of $0.25 and a maximum fee of $25.

Standard Transfers with Venmo are free but take 1-3 days, while Instant Transfers finish in minutes but come with a 1.75% fee.

The below image shows the key differences between standard and instant transfers in a pictographic manner.

You basically have to choose between speed and fees when you send money with Venmo. If you want instant movement of funds, you have to pay a fee. On the other hand, if you can wait for a few days, Venmo money transfers are free.

What are Some Venmo to PayPal Money Transfer Best Practices and Mistakes to Avoid?

Follow the below guidelines and best practices to ensure you maximize the value from your Venmo to PayPal money transfers:

- You can avoid paying Venmo fees by choosing the Standard Transfer option when sending money to your bank account. Even though the money will be available in 1-3 days in your bank account, the advantage of the Standard Transfer is that it is free. Of course, if you need urgent access to funds, you can choose the Instant Transfer option and pay a fee to be able to get hold of your money within a few minutes.

- Keep your Venmo and PayPal accounts linked to the same bank account to easily move money between both wallets. Having your bank accounts already linked and ready will reduce the time needed for movement of money by eliminating the time needed to verify bank accounts.

- Make sure you use the same name for your Venmo, PayPal and bank accounts. This makes it smooth to link the accounts and pass various compliance checks and legal and regulatory requirements without any hassle.

- Do not use Venmo to PayPal money transfers using an intermediary bank account for emergency purposes. If you need urgent access to money, you will end up paying fees every time you opt for speed. Therefore, try not to rely on Venmo to PayPal funds for urgent needs.

- Avoid multi-currency transfers with PayPal as they are expensive – you will lose money due to high fees and lower exchange rates. If currency conversion is involved, use a money transfer company instead.

Venmo is a great option for domestic money transfers within the US. Follow the above best practices to avoid fees or any other surprises.

Above is information about Can I Transfer money from Venmo to PayPal? What Is PayPal? that we have compiled. Hopefully, through the above content, you have a more detailed understanding of I Transfer money from Venmo to PayPal. Thank you for reading our post.