Can you send money from Zelle to PayPal? Introducing the seamless synergy of two financial powerhouses: Zelle and PayPal. Have you ever found yourself wondering if it’s possible to send money from Zelle to PayPal? Well, prepare to be captivated by the answer. In this modern era of interconnectedness, where digital transactions reign supreme, the boundaries between financial platforms are being redrawn.

Today, we embark on a journey to explore the realm where Zelle and PayPal converge, unlocking a world of convenience and endless possibilities. So, fasten your seatbelts and let’s delve into the realm of financial fluidity, as we uncover the answer to that burning question: Can I send money from Zelle to PayPal? Brace yourself, for the answer might just leave you astounded.

Can you send money from Zelle to PayPal?

No, you cannot send money directly from Zelle to PayPal. Zelle is a person-to-person (P2P) payment service that allows you to send and receive money from people in your US contact list. PayPal is also a P2P payment service, but it is not affiliated with Zelle.

If you need to send money from Zelle to PayPal, you will need to use a third-party service. There are a number of companies that offer this service, such as Wise, Payoneer, and Skrill. These services typically charge a fee for transferring money, but the fees may vary depending on the amount of money you are sending and the currency you are sending it in.

Here is a general overview of how to send money from Zelle to PayPal using a third-party service:

- Create an account with the third-party service of your choice.

- Connect your Zelle account and your PayPal account to the third-party service.

- Enter the amount of money you want to send and the recipient’s PayPal email address.

- Review and confirm the transfer.

The third-party service will then transfer the money from your Zelle account to your PayPal account. The transfer may take a few days to complete, depending on the service you use.

How to Transfer Money to Your PayPal?

You may sometimes have to transfer funds from one payment service to another, which is fine. Maybe you use Zelle with your friends and PayPal to pay for things online. You can move your money from Zelle to PayPal easier than you think!

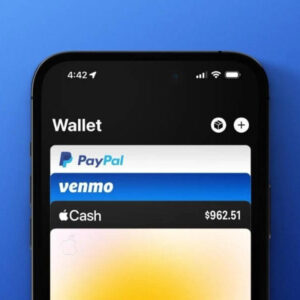

First, unlike Venmo and similar apps, Zelle doesn’t have a wallet. When you use Zelle, you’re actually sending money directly from your bank account.

If your bank account is linked to PayPal, all you have to do is transfer money from bank to PayPal. Here’s how you can do it:

- Open PayPal and log in with your credentials.

- Click on Transfer Money.

- Click on Add Money To Your Balance.

- Enter the amount of money you want to transfer.

- Click on Add.

There you have it! Bear in mind that bank transfers may take 3-5 business days. But that’s just PayPal’s statement to avoid people calling them frantically. In most cases, this is going to take 2 business days.

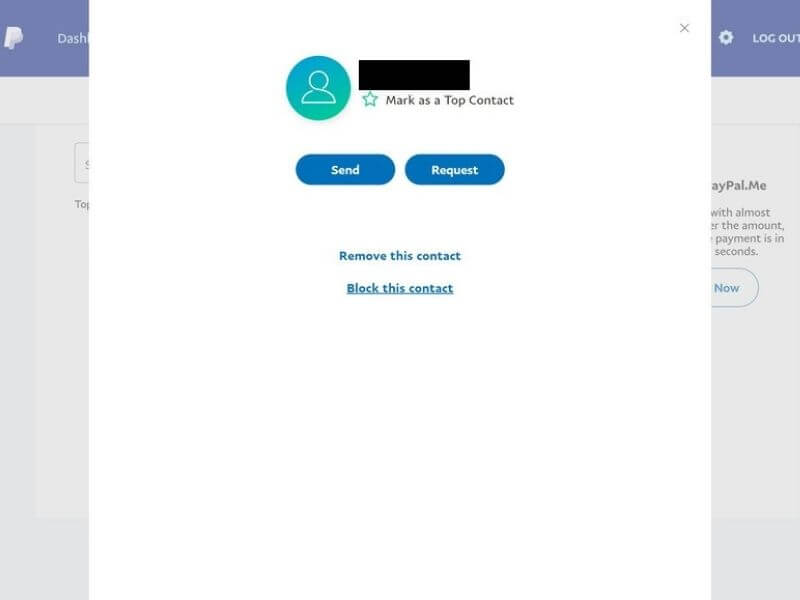

How to Transfer Money to Someone Else’s PayPal?

The good news is that the money is already in your bank account, and when you pay with Zelle you’re actually paying with that account.

The bad news is that you can’t send money to someone’s PayPal unless you have a PayPal account as well. But you can sign up for one for free, and here’s what you have to do:

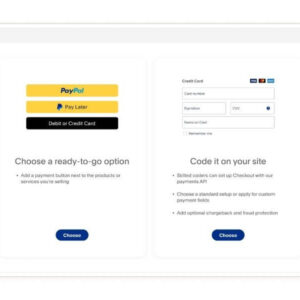

- Go to paypal.com

- Click on Sign Up.

- Choose whether you want to create a personal or business account.

- Then, enter your e-mail and create a password.

- Enter your details: name, phone number, address, etc.

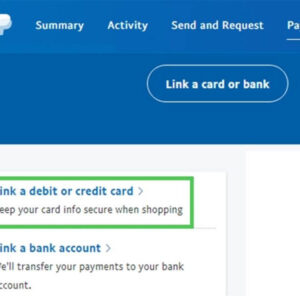

- Then, click on Link Card.

- You can link either a credit or debit card.

That’s it! If there’s available funds on the linked card, you can immediately send money with PayPal. Here’s how:

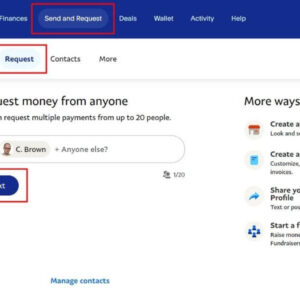

- Click on the Send and Request button.

- Choose whether it’s a business or personal payment.

- Enter the e-mail address or phone number of the person you want to send money to.

- Enter the amount and select a currency (if applicable).

- Click on Confirm.

As you can see, you don’t need a lot of details to send someone money via PayPal. Their phone number or e-mail address should be enough.

Zelle or PayPal: Which Is Better?

This can be a complicated question. Many people would say that Zelle is better as you can make instant transfers at no fee. Moreover, Zelle is integrated into many online banking apps and portals, so you don’t have to remember multiple passwords.

However, PayPal could be a safer option for making online purchases. As you know, there’s no buyer protection with Zelle. You’re on your own if you don’t receive the item purchased or if it’s not as described. On the other hand, PayPal allows you to send a refund request up to 180 days of the purchase.

Everything depends on what you need and who you’re sending money to. Zelle is a free option for sending money quickly to a friend or relative. But if you want to buy something online, PayPal is a much safer service.

Who Said You Have to Choose?

While PayPal has been around and trusted for decades, Zelle is a new service that’s made lives easier, at least in the United States. Why choose one or the other when you can have both? You can sign up for both services just as easily. Neither charges a monthly maintenance fee.

Which payment service do you usually use and why? Share with the community in the comments below.

Understanding the Differences Between Zelle and PayPal

With technology advancing every day, sending and receiving money has become easier than ever before. Two of the most popular digital payment systems used today are Zelle and PayPal. While both offer convenient ways to transfer funds electronically, there are several differences between the two.

Zelle is a peer-to-peer digital payment network backed by several major U.S. banks that allows users to send money directly from their bank account to another individual’s bank account through an app or online banking service. This means that both parties involved in the transaction must have accounts with participating banks or credit unions linked to Zelle in order for the transaction to occur seamlessly.

On the other hand, PayPal is an independent platform that can be linked to a user’s debit or credit card, as well as their bank account, allowing them to send and receive payments easily without any restrictions on which financial institutions they use.

Another difference between these two services is how quickly transactions are processed. Zelle transfers typically happen instantly if both parties have accounts with participating banks already set up in Zelle’s system; otherwise it may take one business day for new users signing up onto the app through their own banking institution that recently partnered with them!

Transactions made via PayPal usually take 1-3 business days because they need time for verification checks due largely impart due in part because of their flexible nature accepting both debit/credit cards as well as a wide range of financial institutions – you’ll need patience when using this platform!

In summary, while both platforms offer similar functionality at surface level (sending/receiving electronic fund transfers), there are various distinctions between what each offers depending upon personal preference such as seamless integration into your current bank/credit union vs full flexibility across multiple providers being important deciding factors which ultimately determine which one suits best based on individual needs!

Above is information about Can you send money from Zelle to PayPal? What is this about? that we have compiled. Hopefully, through the above content, you have a more detailed understanding of send money from Zelle to PayPal. Thank you for reading our post.