Does eBay own PayPal? Do you have to do anything? PayPal Holdings, Inc. is an American multinational financial technology company operating an online payments system in the majority of countries that support online money transfers, and serves as an electronic alternative to traditional paper methods such as checks and money orders. The company operates as a payment processor for online vendors, auction sites and many other commercial users, for which it charges a fee.

Established in 1998 as Confinity, PayPal went public through an IPO in 2002. It became a wholly owned subsidiary of eBay later that year, valued at $1.5 billion. In 2015 eBay spun off PayPal to its shareholders, and PayPal became an independent company again. The company was ranked 143rd on the 2022 Fortune 500 of the largest United States corporations by revenue.

Does eBay own PayPal?

Online marketplace eBay will now pay its sellers directly rather than through online payment giant PayPal under new rules which came into effect on 1 June, marking an end to a 19-year partnership.

Buyers can still use PayPal to purchase items, but the selling process now takes place solely via eBay’s managed payments system from start to finish.

eBay says the new system is simpler, more convenient and gives buyers more payment options. But Which? has spoken to one eBay user who is ditching the marketplace, after experiencing delayed payments under the new arrangement.

Here, Which? looks at how the changes will affect buyers and sellers plus what protections eBay’s new system has.

What does the overhaul mean for eBay users?

eBay and PayPal separated in 2015 as eBay initiated plans to simplify the buying and selling experience for users.

Although its new terms officially came into effect on 1 June 2021, eBay UK started managing payments last year, becoming the third market to introduce its managed payments experience after the US and Germany.

eBay says it now has a single source for fees, customised reports, simplified protections, refunds, and dedicated support.

We have outlined the key changes for sellers and buyers below.

Do you have to do anything?

eBay says users should have received an email invitation asking them to complete managed payments registration by a specific date.

The online marketplace started inviting both business and private sellers to join in July 2020. Many sellers had a deadline of 31 May to join the new system, although eBay told Which? not all have moved to its new checkout and payments process just yet.

eBay’s terms and conditions make using the new setup compulsory, so make sure you check your emails for your deadline to move to the new system, and update your account details so it can start managing your payments.

The rollout should complete by the end of 2021. If you have any concerns, you can contact eBay’s customer service team on 0345 355 3229.

Do the changes mean fewer protections?

Now that buyers can use other forms of payment on eBay directly such as a credit card or debit card it’s worth considering the protections on offer.

eBay told Which? that managed payments should not only make ecommerce simpler to sell and get paid, but also manage the entire sales process. It’s hoped that under eBay managed payments, it’s operations will run smoother with simplified fees, integrated reporting, streamlined support, and ultimately the ability to mitigate and lower seller risk.

It also noted it does not have direct access to personal bank accounts. Sellers will provide a direct debit mandate to eBay, which will need to be verified by the seller’s own bank. eBay must provide advance notice of amounts to be collected by direct debit, and protections apply to sellers such that they would be able to obtain a refund in the event of fraud or incorrect payments.

Purchases made with a credit card worth between £100 and £30,000 benefit from Section 75 protection which means you will get your money back if anything goes wrong with your order.

Debit cards and credit cards benefit from chargeback which can reverse a transaction, however, this protection is not enshrined in law like Section 75 is.

PayPal’s buyer protection policy promises to safeguard users against breaches of contract, including missing deliveries, or when items turn out to be fake, faulty, or not what was expected.

Last year we surveyed PayPal customers who have made a claim and found that 71% were satisfied with how their claim was resolved.However, we found some PayPal customers have found it difficult to get reimbursed when they ran into problems – particularly victims of fraud.

It’s less clear whether eBay’s own systems will be more or less secure than PayPal for sellers, but eBay told Which? it has ‘simplified protections’ for sellers.

PayPal holds a banking licence, similar to a high street bank but with some limitations as it was granted in Luxembourg, such as accounts not qualifying for Financial Services Compensation Scheme protection, which safeguards up to £85,000 of deposits per institution per person.

Now that eBay will pay sellers directly into their bank accounts this is likely to mean sellers will benefit from FSCS protection on offer from their bank via their personal accounts, as long as they don’t exceed the £85,000 limit.

What Does This Mean for the Future of Payments?

PayPal’s expected bright future despite the shift at eBay shows us, among other things, that convenience and trust is still going to be key when it comes to retail payments. Those payment brands that make things easy for customers and that they have confidence in will be the ones that help retailers win in the battle for conversions. And those will include options like e-wallets from PayPal, AliPay, MasterPass and WeChat, as well as tried and true options like domestic credit cards.

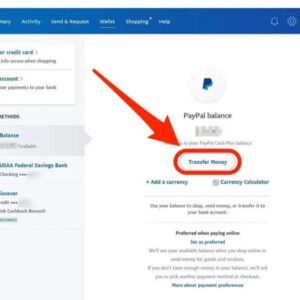

Beyond those, we are starting to see evidence of the rising popularity of bank accounts for ecommerce payments due to the introduction of Faster Payments in the U.S. and UK and Instant Payments in Europe. These make it much faster, easier and more convenient for customers to send money from account to account.

Historically, in Europe, with 28 member states and just as many banking systems, it had been difficult, expensive and slow to transmit money between countries. However, with SEPA Instant Payments announced for 2018 it will be easy, fast and cost-effective to send money to any European account within 10 seconds, 365 days per year.

As shown, convenience appeals to shoppers’ wants and needs. In the not-too-distant future, this will be reinforced with innovations in the retail space. We will be living in a world where our devices will process payments for us, and virtual and augmented reality will present new sales channels. We’re already seeing user names and passwords being replaced with biometric authentication like fingerprints, face and voice recognition for payments. For e-commerce, we won’t have to type in complex passwords on small touch screens anymore.

Those payment options that support innovations like these and are easy, efficient and secure for shoppers will be the ones that will reign supreme moving forward.

Above is information about Does eBay own PayPal? Do you have to do anything? that we have compiled. Hopefully, through the above content, you have a more detailed understanding of eBay own PayPal. Thank you for reading our post.