What is Amazon Pay? Amazon Pay is an online payments processing service owned by Amazon. Launched in 2007, Amazon Pay uses the consumer base of Amazon.com and focuses on giving users the option to pay with their Amazon accounts on external merchant websites. As of March 2021, the service became available in Austria, Belgium, Cyprus, Denmark, France, Germany, Hungary, India, Republic of Ireland, Italy, Japan, Luxembourg, Malaysia, Netherlands, Portugal, Spain, Sweden, Switzerland, United Kingdom, and the United States.

Amazon Pay announced a partnership with Worldpay in 2019, allowing Worldpay clients to enable Amazon Pay as a part of the same integration

What is Amazon Pay?

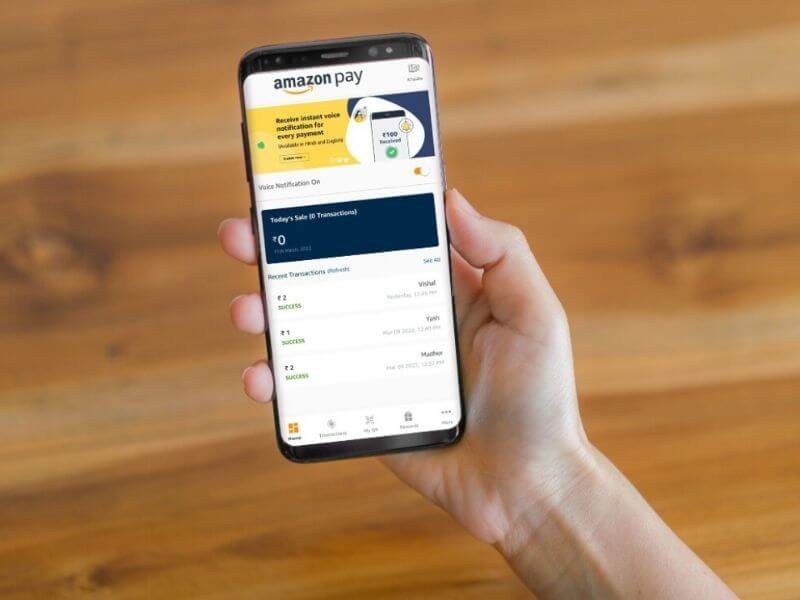

Amazon Pay is an online payment processing service owned by Amazon. It was launched in India in February 2019. It works in collaboration with Axis Bank for the UPI IDs. Customers are allowed to link their bank account to their Amazon mobile app and make payments quickly, easily and securely, directly from their bank account.

Customers will be allotted an Amazon Pay UPI ID to buy on Amazon.in or the Amazon App as well as make payments for their regular needs, including mobile recharges and bill payments, without accessing their bank accounts, debit card or credit card or going through the hassle of authentication in their banking system.

Amazon uses UPI (Unified Payments Interface) of India to allow customers to pay for goods and services on the Amazon site or other merchant sites. Amazon Pay can be linked to multiple bank accounts and you can choose the bank account you want to debit the payment from at the time of checkout. You can also load money into your Amazon Pay account through your credit card or debit card for faster checkouts at the time of purchases on Amazon App or Amazon.in.

Why Are Third-Party Payment Gateways a Thing?

As ecommerce grew, so did the need for secure online payment solutions protecting both sellers and their buyers.

To accept payments online, sellers needed merchant bank accounts. These accounts would often cost money to set up and charge transaction fees. They also came without the crucial layer of security that payment providers now offer, which protects the sensitive information shared between sellers and buyers, ripe for the taking by digital hackers.

Whilst sellers can still opt to use merchant bank accounts instead of third-party solutions, they miss out on an encrypted mediator handling the money and risk for them.

Today, gateways like PayPal, Amazon Pay, and Stripe lend sellers a certain level of esteem by association. They are established brand names with a track record for being safe, helping buyers to feel secure in sharing their personal details online.

With the increased awareness of data hacking and fraud, there is certainly a need for sellers to reassure their buyers. In a report conducted by pwc in 2017, it was found that:

- 92% of respondents agree that companies must be proactive about data protection.

- Only 25% believe that most companies handle their data responsibly.

- Just 12% of consumers trust companies more than they did a year ago.

- And 69% believe companies are vulnerable to hacks and cyber attacks.

What does this tell us? That consumers today are savvy. Internet security matters to them and there are plenty of examples of when this goes wrong and sinks businesses.

Aligning yourself with a third-party payment gateway gives you that level of specialist protection as well as a reputable logo to verify your reliability as a seller.

What are the advantages of using Amazon Pay?

- The primary benefit of Amazon Pay is a faster and easy checkout process as you don’t have to go through the entire process of entering your bank details or card details to complete the payment process.

- One stop solution to pay using multiple channels like your UPI, Amazon Pay Balance, Gift Cards, Debit & Credit Cards, Net Banking

- Amazon Pay is highly secure and keeps your personal information safe for an enhanced payment experience.

- Amazon Pay Guarantee protects qualified purchases

- You can use Amazon Pay on more than 10,000 online shopping sites.

- Use Alexa Voice Command to make purchases and donations.

- For merchants, an easier payment process results in higher business.

- Flattering deals, great savings, unlimited savings on Amazon Pay Co-Brand Credit Card.

- Amazon Pay EMI allows consumers who do not have access to credit to earn credit up to Rs 1 Lakh and make repeated transactions over a month and pay the next month or through simple EMIs.

- Transfer cash to friends and family with Amazon Pay UPI quickly via your phone contacts or ask them to transfer money and earn incentives.

- Pay conveniently with your favourite payment options for your monthly bills like utility bills, DTH and mobile recharges.

How to register on Amazon Pay?

Amazon users can start using Amazon Pay anytime. They just have to accept the Terms & Conditions and Amazon Pay is ready for use. It does not need a separate registration process.

What can Amazon Pay be used for?

The applications of Amazon Pay are a lot. Here are some things you can use Amazon Pay for:

- Recharge prepaid mobile number or make postpaid mobile bill payments

- Shop online on Amazon or 10,000+ other online shopping outlets

- Transfer money to family & friends from your bank account to their account using phone number

- Make monthly utility bill payments, DTH recharges, credit card payments, insurance premium payments, gas connection, broadband bills, municipal taxes, and many more

- Plan your travel; book flight tickets, bus or train tickets, hotel bookings, and more

- Get attractive rewards when you book your movie tickets through Amazon Pay

- Purchase and send gift vouchers, birthday gift cards, or any other special occasion.

- Pay and get amazing rewards with partner brands for food orders, stores near you, health & fitness expenses and more

- Link multiple bank accounts to your Amazon Pay for convenience. You can check your bank balance through Amazon Pay.

FAQs

I already have an UPI ID created using a different app connected to my bank account. Can I also set up the Amazon Pay UPI ID for the same bank account?

Yeah, you can set up your Amazon Pay UPI ID and connect it to the same bank account. You can have several UPI IDs connected to the same bank account.

Is PAN Card mandatory to register for Amazon Pay Later registration?

Yes, PAN number is mandatory for completing Know Your Customer (KYC) process. Without a PAN, you will not be able to complete the registration for Amazon Pay Later.

Is my Amazon Pay payment information shared with merchants?

No, your account information is not shared with the merchant.

How do I change my account information on Amazon Pay?

You can manage your Amazon Pay account Amazon.in or the Amazon App. Go to the Amazon Pay dashboard to manage your account.

Above is information about What is Amazon Pay? How to register on Amazon Pay? that we have compiled. Hopefully, through the above content, you have a more detailed understanding of Amazon Pay. Thank you for reading our post.